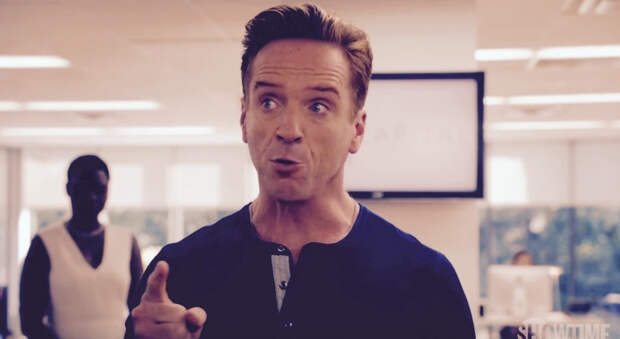

How do you rebound from the biggest insider trading scandal in U.S. history? Easy. Round up $20 billion and launch the biggest U.S. hedge fund. Ever. At least, that’s what Steve Cohen does.

The guy you stole lunch money from when you were in high school that went on to be one of the wealthiest billionaires in the U.

S. and inspire the Showtime drama, Billions.Cohen’s story started when he scraped $7,000 from his Wharton tuition to start trading. The rest was history.

The fresh-faced grad was quickly making Gruntal & Co. $100,000 a day and managing a $75 million portfolio. By 1992, Cohen started SAC Capital Advisors with $20 million…

of his own money.

Under Cohen’s guidance, SAC grew to be a $16 billion fund with a 30% annualized return. A nice compliment to his $1 billion personal art collection, pickled shark and all.

But the party was short-lived thanks to Matthew Martoma. Cohen’s right-hand man made $276 million in avoided losses and combined profits in drug makers Wyeth and Elan.

One small issue––Martoma acted on inside information about preliminary drug trials for the companies’ new Alzheimer’s medication.

Martoma got nine years in the penalty box for insider trading, while SAC forked over $1.8 billion to the SEC and changed its name to Point72 Asset Management.

As for our pal Stevie, he can now only manage his own funds.

Shackled to his 1,000-person family office since 2013, Cohen has managed $11 billion of his OWN money. But when the chains come off in 2018, he might just be looking for $9 billion more in funding.

A move that might not be so easy. Investors shifted $106 billion away from hedge funds in 2016, allocating much of it to passively-managed low-cost index funds.

And with an industry now returning just 5.34%, let’s hope Wall Street’s bad boy still has what it takes.

As if Uber isn’t in hot water already. Amidst ongoing legal drama with Alphabet (+0.29%), Uber’s lead self-driving engineer Anthony Levandowski just got the ax.

Here’s the breakdown: Levandowski worked on Google’s self-driving car project Waymo, but ultimately left when he founded Otto, a self-driving truck start-up that Uber acquired for $680 million in August.

Fast-forward, and now Alphabet’s accusing Levandowski of stealing trade secrets to use at Otto—and later at Uber.

Since the February lawsuit began, Levandowski has Plead the Fifth. His failure to comply with the investigation left Uber with no choice but to fire him, leaving the company without the star of its autonomous team.

Two years after leaving ESPN and six months removed from his unsuccessful stint at HBO, sports commentator Bill Simmons is onto the next one. Yesterday, he struck a deal with Vox Media to “host” The Ringer, his sports and culture site.

Quick Q & A

Simple. Simmons maintains ownership of The Ringer, while Vox sells its ads, and the two collect their pre-negotiated slice of revenue.

It’s a big blow for an already-struggling Medium (Simmons’ current host), while a big opportunity for Vox, who is new to hosting.

Hopefully for Bill, third time’s a charm.

In March, home prices rose at their fastest clip in nearly three years. Case-Shiller Home Price Index, an industry gold standard, pegged growth at 5.9% YoY.

Seattle floated to the top (at 12.3%), while NYC sunk to the bottom (at 4.1%).

Time to find a rooftop and break out the champagne, amirite? Not quite…

As Mr. and Mrs. hopeful homebuyer search for that cozy 3 bed, 2.5 bath, they are quickly realizing “it was all a dream“.

Rock-bottom inventory, price appreciation twice as fast as income growth and rising mortgage rates, truly are the Mr. and Mrs’ worst nightmare.

On the follow of two momentous occasions (hitting $1,000 stock price and just over 20 years since IPOing) for e-tail giant, Amazon, Brew Crew thought it only right to kick off the Gimme series with little-known facts about Bezos and his brainchild.

A Larry Page favorite…

Teach me something I don’t know in five minutes.

(One Possible Answer)

I founded my first business at the age of 16. It was a magazine called Student.

I bought an island in 1978 for $180,000, which is now worth upwards of $200 million. I’ve been known to entertain very, very “distinguished” guests.

I founded a company in 1970 that now employs over 71,000 people and contains over 400 different companies.

It all started as a record business.

Who am I?

(I am…)

$1 billion.

That’s what state-owned Swedish mining company, LKAB, will be spending to transport the town of Kiruna 3 km (or 1.86411 mi) to the east.

Why in god’s name would a company do this?

It kind of doesn’t have a choice.

LKAB will either totally rebuild the community’s homes or dismantle and reassemble commonplaces (like the church) to stop Kiruna from falling into a possible sinkhole created by its iron ore mine.