…as Airbnb closes a $1 billion dollar round of funding. Ca-ching! It was quite the payday for the home-sharing giant, as the latest round of funding pegs Airbnb at $31 billion—aka the second-most valuable startup in the U.S. (we see you, Uber). And, for bonus points: the company turned profitable in Q2 last year and fully expects to continue the trend in 2017.

It’s clear that Airbnb has been expanding rapidly and has also made a couple of key acquisitions to help widen its scope. Yet, the company is still facing increased legal pressure from city authorities around the world (those pesky hotel regulations). And what about that IPO? Apparently, it’s gonna be awhile.… because RadioShack is officially bankrupt (again). The electronics giant announced it will close 200 stores this month and keep the rest functioning to test the post-crisis waters. The one-stop shop for walkie-talkies, cassettes and all things ‘70s tried to keep up with the times by stocking the latest gizmos, but customers didn’t quite tune in and instead turned to online giants like Amazon, instead. And that RadioShack–Sprint partnership (post-bankruptcy one) looks to have fell flat on its face—in fact, all fingers point towards Sprint’s sliding sales for pushing RadioShack into bankruptcy two. Some friend.

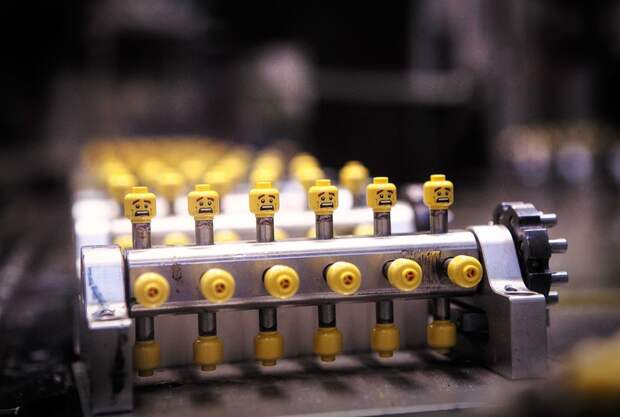

… because Lego reported its highest revenue in its 85 years of history. Don’t get too excited just yet. Profits remain low historically, and US sales have been flat despite marketing attempts and the creation of close to 350 new products this year. The toy manufacturer must now also brace for slower growth after seeing its revenues double in the past five years as it continues to grow globally.

…For a Cool $8.5 Billion. Royal Dutch Shell (+0.57%) is joining the short list of oil and gas companies, including Exxon Mobil (+0.79%), that are selling their Canadian oil sands assets. Shell is selling 90% of its oil sands to Canadian Natural Resources Ltd (+9.69%) in order to withdraw from unsafe and costly operations. Shell execs hope to diversify their energy assets while leaving less of a carbon footprint as they move into the future. On top of that, Shell announced that a portion of directors’ bonuses will be linked to the amount of greenhouse gas emissions throughout operations. Good luck going green(ish)!

Want to break the rules and get paid for it? M.I.T.’s Media Lab created an award, literally called the disobedience award, boasting a $250,000 cash prize, no strings attached. The criteria: “engage in what we believe is an extraordinary example of disobedience for the benefit of society.” Sounds fun:

On a circle there are 2014 light bulbs, 2 are ON, and 2012 are OFF. You can choose any bulb and change the neighbor’s state, i.e. ON to OFF or OFF to ON. Doing so, what is the maximum number of bulbs we can turn on? (Answer)

The market has been in a historic bull run since its low eight years ago on March 9, 2009. By March 9, 2009, the S&P 500 had dropped 56.8% from its record high in 2007. The S&P 500 reached a new record high four years later, on March 28, 2013, and it has continued to soar, like a, well, bull with wings. Check out the chart here.

U.S. household net worth climbed to a record $92.8 trillion in Q4 2016, as the end-of-year surge in stocks and a steady climb in home prices added more than $2 trillion of wealth to household balance sheets. This is especially compelling in light of the U.S. homeownership rate across all ages, 62.9%, which has now fallen to its lowest level in more than five decades.